According to a new global study by the International Center for Media and Public Affairs using IBM's Many Eyes software for data visualization children are increasingly developing symbiotic relationships with their technology.

Throughout the study technology was repeatedly referred to in metaphorical terms comparing it to an appendage or a drug. Many young people spoke of acute withdrawal symptoms.

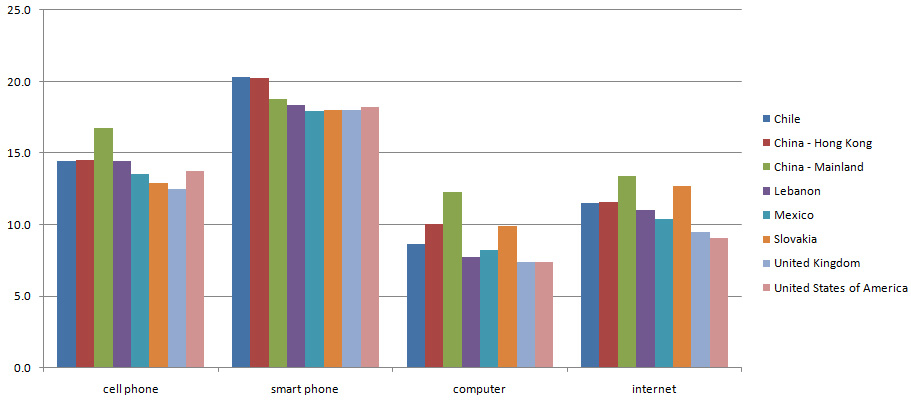

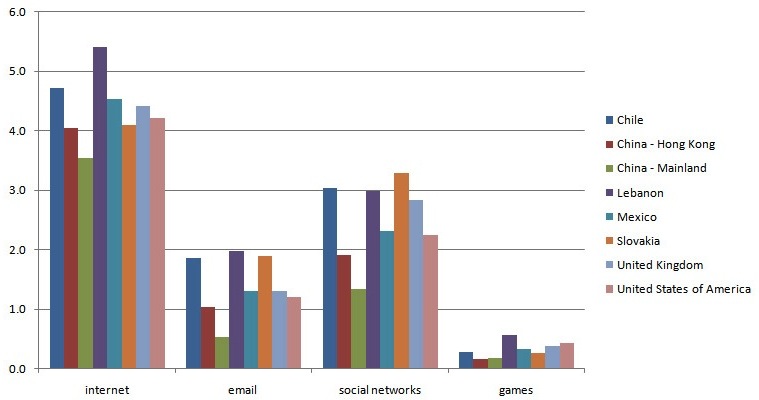

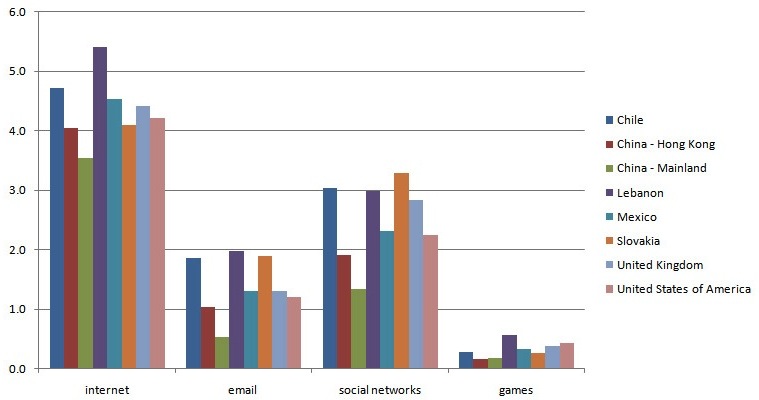

As you can see below young people from Chile, China, Mexico, Lebanon, Slovakia, the U.S. and Great Britain spend 3.5 to 5.5 hours a day on the Internet at least half of which is spent wandering around social networks.

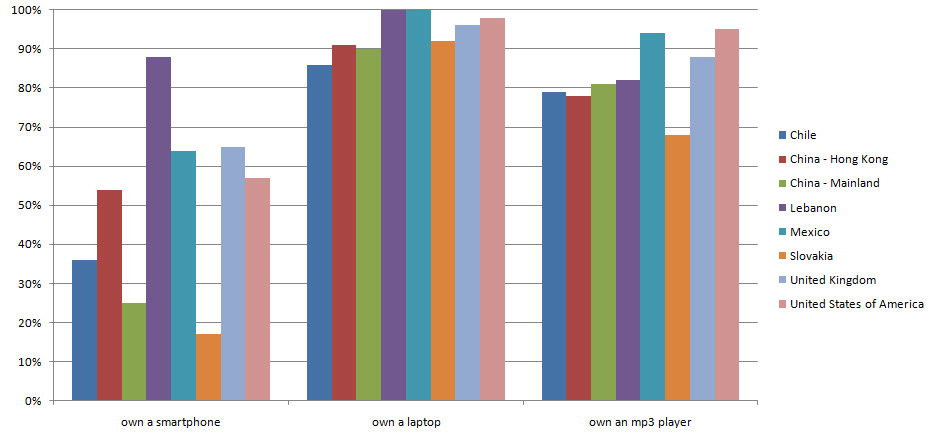

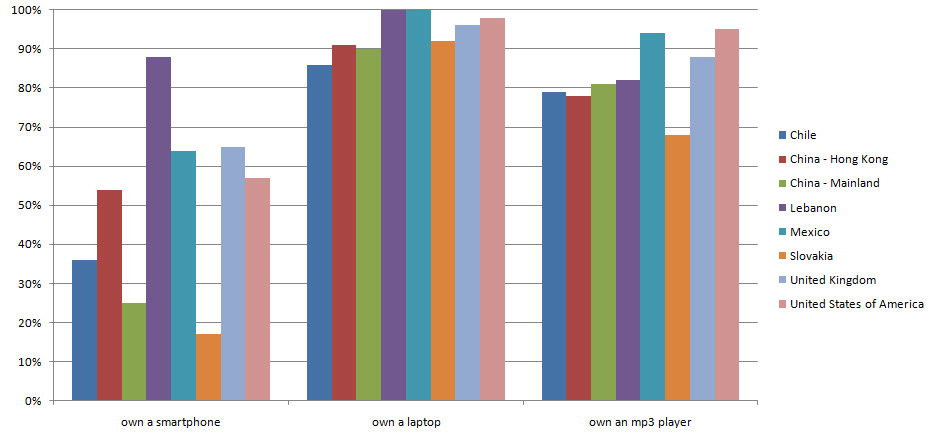

Somewhat surprising is the lack of smartphone penetration in quite unexpected markets. Notice that both Lebanon and Mexico have wider penetration than the United States.

Students were encouraged to abandon their devices for 24 hours. Although some students reported benefits of their unplugging experiment the majority felt lost, irritable and bored without their electronic appendages.

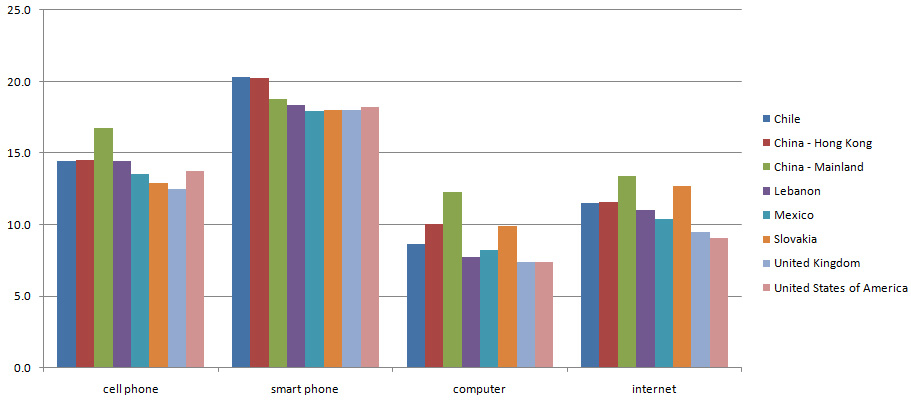

This is perhaps attributable to the near constant presence of technologies in their lives as seen in this final graph detailing their first age when using key technologies such as the smartphone, the PC and the internet.

Throughout the study technology was repeatedly referred to in metaphorical terms comparing it to an appendage or a drug. Many young people spoke of acute withdrawal symptoms.

As you can see below young people from Chile, China, Mexico, Lebanon, Slovakia, the U.S. and Great Britain spend 3.5 to 5.5 hours a day on the Internet at least half of which is spent wandering around social networks.

Somewhat surprising is the lack of smartphone penetration in quite unexpected markets. Notice that both Lebanon and Mexico have wider penetration than the United States.

Students were encouraged to abandon their devices for 24 hours. Although some students reported benefits of their unplugging experiment the majority felt lost, irritable and bored without their electronic appendages.

This is perhaps attributable to the near constant presence of technologies in their lives as seen in this final graph detailing their first age when using key technologies such as the smartphone, the PC and the internet.